Join a community of the most creative Business Intelligence Professionals

Join a community of the most creative Business Intelligence Professionals

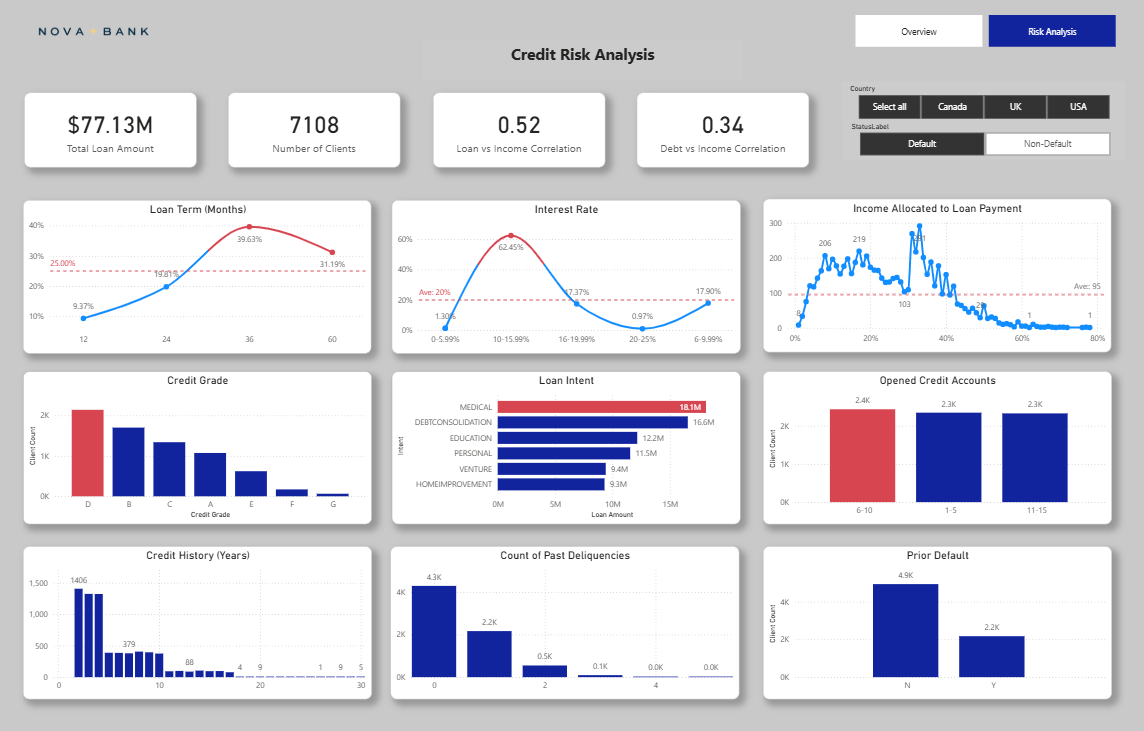

Trends identified based on default loans data: Loan Affordability: Defaults strongly linked to high loan-to-income ratios (correlation = 0.52). Borrowers allocating >30% of income to loan payments show sharp risk increases. Loan Structure: High risk of defaulting is at 6% - 16% interest rates along with the length of loan which are all risky at 36-month to 60-months. This means the longer the payment term, combined with the high interest gives real risk exposure. Borrower Profile: Credit Grade D borrowers dominate defaults. Loan Purpose: Medical and Debt Consolidation (which are mostly in Grade D) loans carry the largest default exposure. Recommended Actions: Tighten Affordability Limits → Cap loan payments at ≤30% of income. Reprice or Restrict High-Risk Segments → 36-month terms, 6–16% interest loans, and Grade D borrowers. Strengthen Underwriting → Give heavier weight to credit history. Manage Loan Intent Risk → Reduce exposure to Medical and Debt Consolidation loans. Portfolio Rebalancing → Shift approvals toward Grades A–C to stabilize default rates.

Contact our team

16 Upper Woburn Place, London, Greater London, WC1H 0AF, United Kingdom