Join a community of the most creative Business Intelligence Professionals

Join a community of the most creative Business Intelligence Professionals

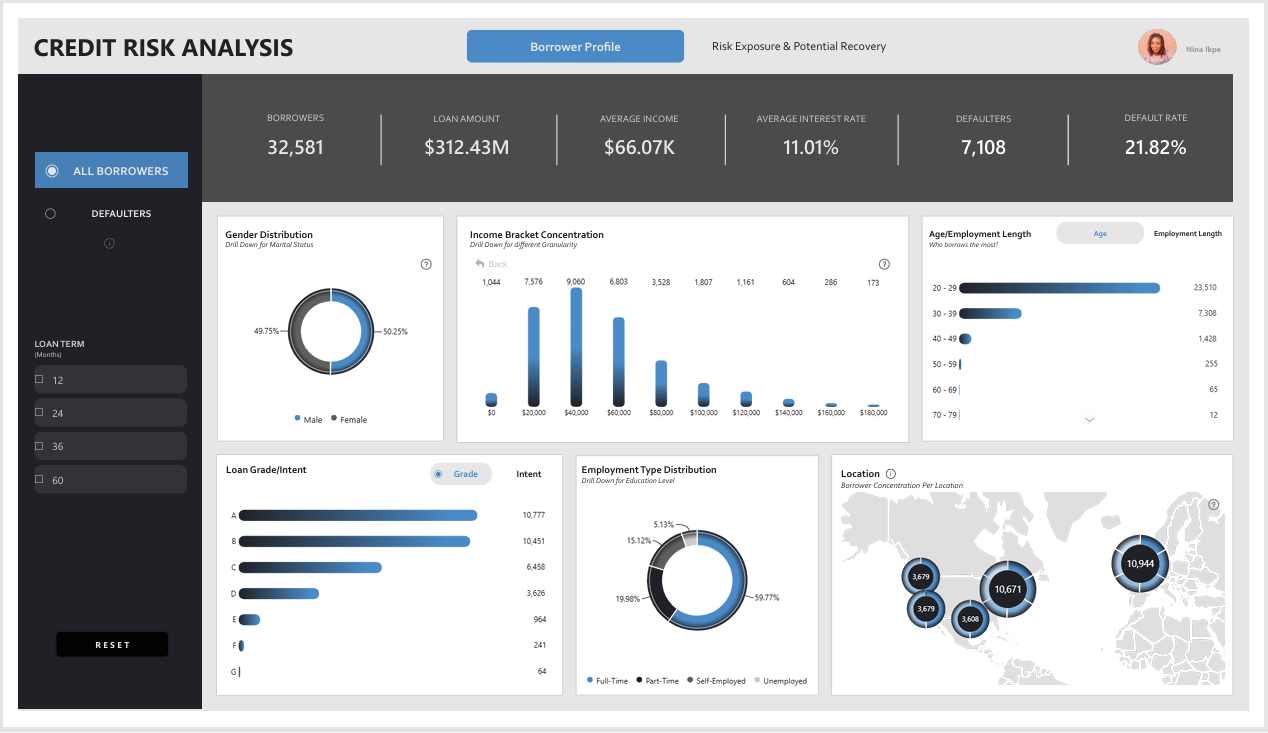

This report provides insights into Nova Bank’s loan portfolio by analyzing Borrower Profile, loan performance, and overall credit risk. It is designed to help the bank identify high-risk borrower segments, improve lending strategies, and safeguard financial sustainability while ensuring fair access to credit. Page 1 – Borrower Profile This page presents an overview of the borrower base, highlighting demographics such as age, gender, marital status, income, employment length, education level, Loan intent and Location. A field parameter that allows switching between ALL BORROWERS and only DEFAULTERS, enabling side-by-side comparisons of borrower groups. This view helps reveal patterns that distinguish safer borrowers from those more likely to default. Page 2 – Risk Exposure and Recovery Potential This page explores the bank’s financial exposure, with visualizations on Loan Amount by loan grade, Intention, Employment Length, Income etc. It also explores a comparison between borrowers from USA, UK, and Canada. Users can switch between ALL BORROWERS and DEFAULTERS to analyze portfolio-wide exposure versus default-driven risk. The section also estimates loss potential from defaults and contrasts it with recovery potential, giving management a balanced view of both downside and upside in risk management.

Contact our team

16 Upper Woburn Place, London, Greater London, WC1H 0AF, United Kingdom